what is a deferred tax provision

600 It is important to keep in mind that the requirements of FRS 102 are to measure deferred tax using the tax rates and laws that have been enacted or substantively enacted by the reporting date that are expected to apply to the reversal of the timing differences. Journal Entry of Provision for Income Tax.

This is below the line entry.

. Since the Work Opportunity Tax. Web based on the provisions of Section 161 b of the Income Tax Act which prohibits a deduction in respect of capital expenditure or any loss diminution or exhaustion of capital. Interim reporting effective tax rate IAS 3430a requires the use of the so called effective tax rate ETR method as the most appropriate depiction of a reporting issuers tax provision on a quarterly basis.

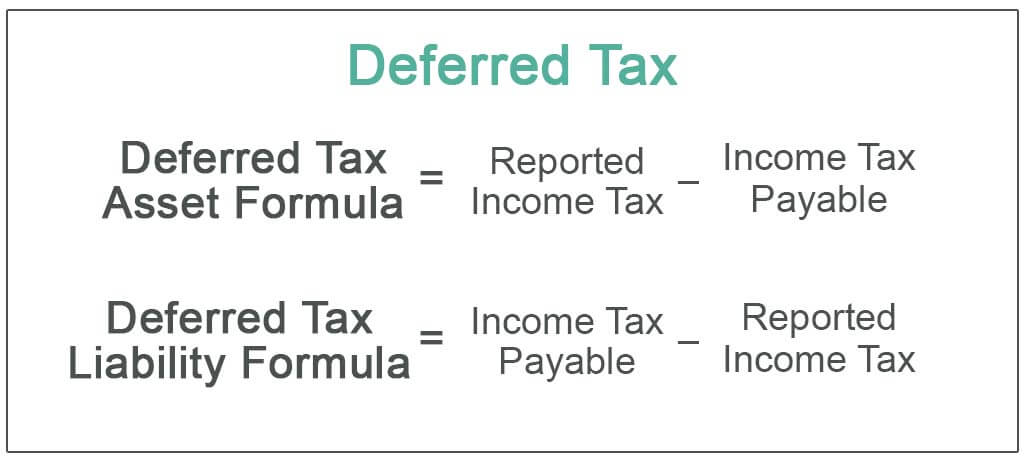

Web Estimating each years tax provision is not a menial task and can require a great deal of time and effort for corporate tax departments. A companys tax provision has two parts. The deferred tax may be a.

It can be. Web To understand deferred tax it shall be noted at the outset that as per the accounting standards followed by companies there are two different financial reports which an organisation prepares every fiscal year an income statement and a tax statement. Web Furthermore a tax-exempt employer may claim the Work Opportunity Tax Credit on Form 5884-C Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans without regard to whether the employer has deferred deposit and payment of the employers share of Social Security tax.

Non-taxable items Non-deductible items Temporary differences Deferred tax align taxable income with accounting profit in relation to temporary differences Tax rate recon. Web Deferred tax charge is not a provision for tax but is a provision for tax effect for difference between taxable income and accounting income and further that deferred tax charge cannot be termed as income-tax paid or payable which has to be paid out of the profit earned. Two common financial statements used by most businesses are the income.

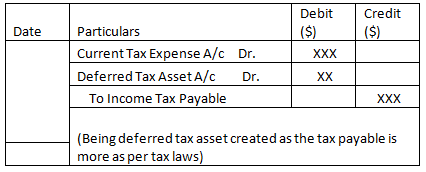

Web 1 Provision for Income Tax. Note that there can be one without the other a company can have only deferred tax liability or deferred tax assets. The liability is created not due to Company defaulting on its tax liabilities but due to timing mismatch or accounting provisions Accounting Provisions The provision in accounting refers to an amount or obligation set aside by the business for present and.

The company usually either has deferred tax liability or deferred tax asset as. Web Deferred tax liability is a tax that is assessed or is due for the current period but has not yet been paid. After adjusting necessary items from gross profit eg.

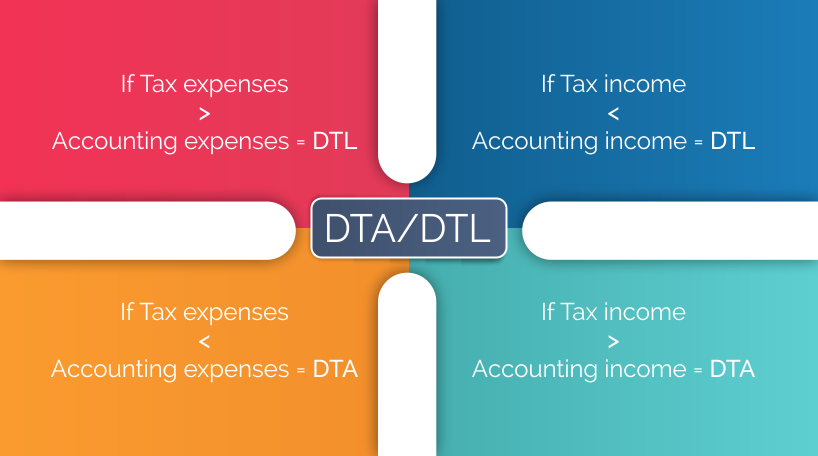

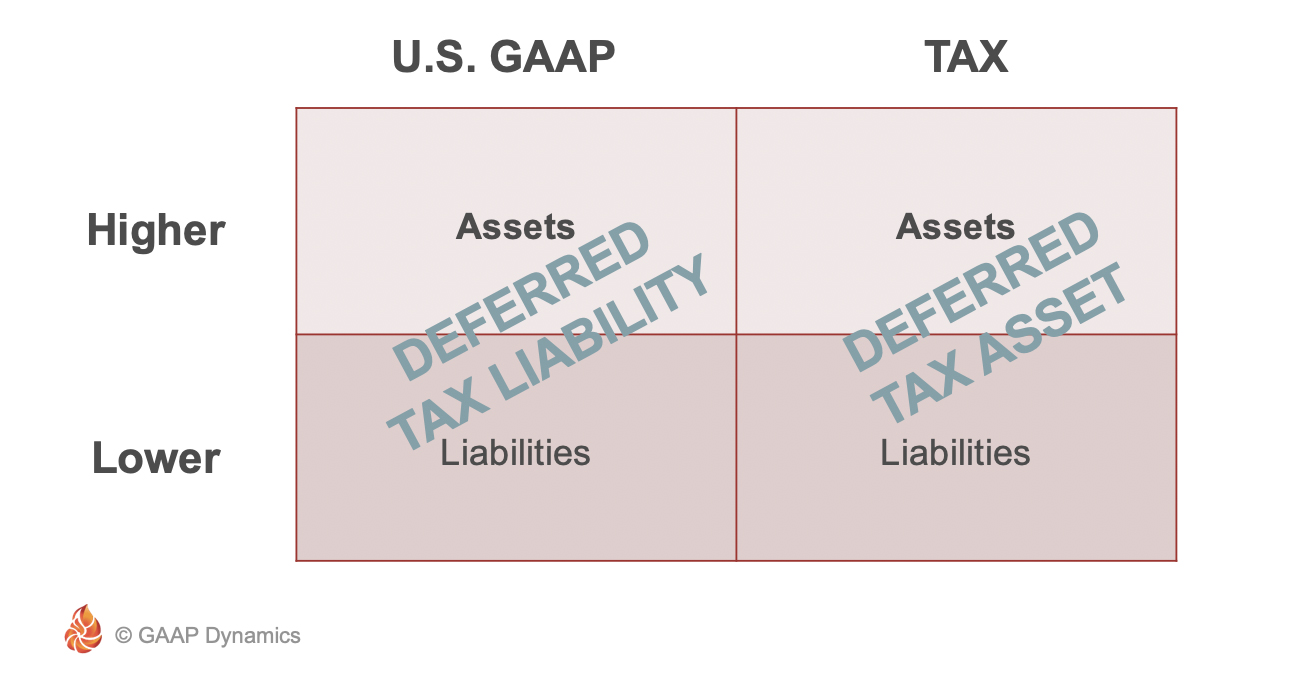

Deferred tax is the tax effect that occurs due to the temporary differences either taxable temporary difference or deductible temporary difference. Web The word Deferred is derived from the word Deferments which means arranging for something to happen at a later date. Interest expense is an allowable cost for corporation tax in line with the provision of the ITA.

Web Underover provision of tax in a prior year Arising on temporary differences. The primary motive behind the creation of two different financial reports is varying guiding. Reserves mentioned in Section 115JB are different it can be unilaterally.

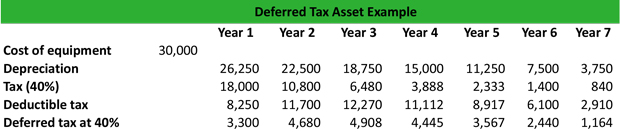

All of this terminology can be rather overwhelming and difficult to understand so consider it alongside an example. Web Deferred tax assets in the balance sheet line item on the non-current assets are recorded whenever the Company pays more tax. Web IAS 12 requires that a deferred tax liability is recorded in respect of all taxable temporary differences that exist at the year-end this is sometimes known as the full provision method.

Where this interest expense is unwound in CBAIs profit. Tax expense per SOCI 28 of profit before tax but it is not due to. Web Deferred tax is a notional asset or liability to reflect corporate income taxation on a basis that is the same or more similar to recognition of profits than the taxation treatment.

The amount under this asset is then utilized to reduce future tax liability. The difference in the deferred tax calculation of book profits and tax profits may lead to the recording of deferred tax assets. How provision for tax is calculated.

Web Deferred tax liability is created when the Company underpays the tax which it will have to pay shortly. Deferred tax liabilities can arise as a result of corporate taxation treatment of capital expenditure being more rapid than the accounting depreciation treatment. Current income tax expense and deferred income tax expense.

This provision is created from profit. Thus deferred tax is the tax for those items which are accounted in Profit Loss Ac but not accounted in taxable income which may be accounted in future taxable income vice versa. Web Dr Deferred tax provision.

Web a provision is recognised under IAS 37 which will be deducted from taxable income in the future on a cash basis liabilities for long-term employee benefits are recognised under IAS 19 which will be deducted from taxable income in the future on a cash basis impairment loss is recognised for assets other than goodwill and it does not. On that taxable profit we have to make provision for income tax at. Web Deferred tax could be deferred tax asset or deferred tax liability in which it will be deductible or taxable in the future.

600 Cr Deferred tax in profit or loss. Depreciation booked in books of accounts and depreciation allowable as per income tax rules taxable income arrives. Web This could result in a change in the appropriate tax rate used to measure certain components of deferred tax.

To make things more complicated most accounting.

Deferred Tax Liabilities Meaning Example Causes And More

What Is A Deferred Tax Asset Definition Meaning Example

What Is Deferred Tax Asset And Deferred Tax Liability Dta Dtl Taxadda

Deferred Tax Liabilities Meaning Example How To Calculate

What Is A Deferred Tax Liability Dtl Definition Meaning Example

Net Operating Losses Deferred Tax Assets Tutorial

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Deferred Tax Asset Deferred Tax Assets Vs Deferred Tax Liability

Define Deferred Tax Liability Or Asset Accounting Clarified

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Define Deferred Tax Liability Or Asset Accounting Clarified

Deferred Tax Meaning Expense Examples Calculation

Worked Example Accounting For Deferred Tax Assets The Footnotes Analyst

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

Deferred Tax Asset Journal Entry How To Recognize

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)