september child tax credit payment short

They waited for the money and any answers from the Internal. September 27 2021 The Internal Revenue Service IRS has made 2021 Advance Child Tax Credit payments since July.

Irs Releases Child Tax Credit Payment Dates Here S When Families Can Expect Relief

The next child tax credit payments will start arriving on September 15.

. 15 monthly payout for the advance child tax credit didnt arrived as scheduled for a sizable group of families. Monthly checks have ended for now. As part of The American Rescue Plan nearly every family can get the expanded Child Tax Credit.

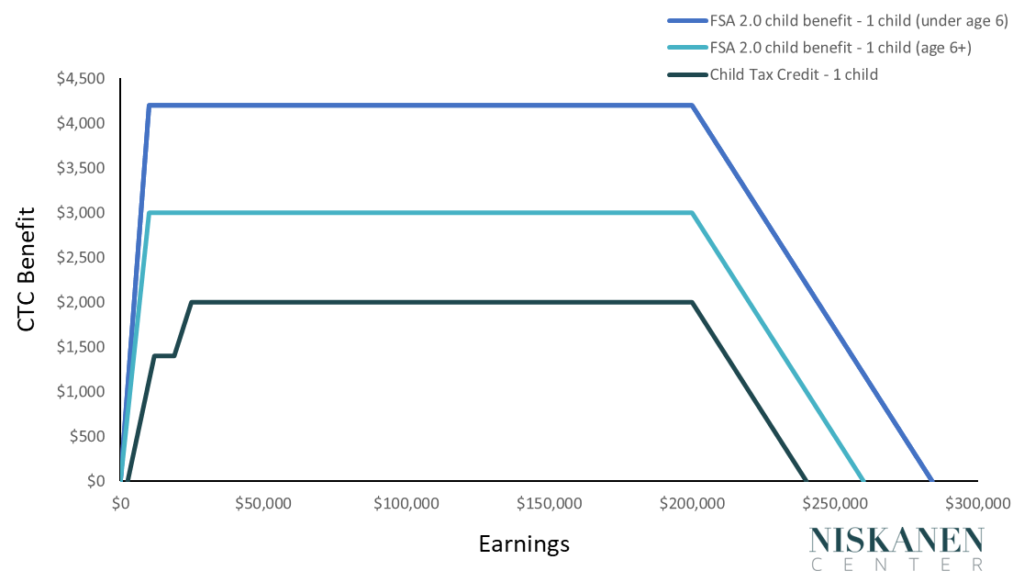

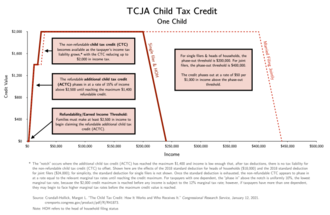

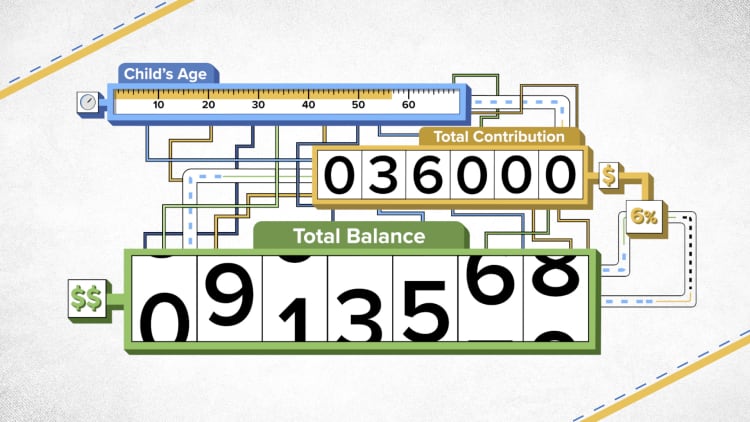

The third of the six advance monthly Child Tax Credit payments will hit bank accounts 15 September. The total child tax credit for 2021 is 3600 for each child under 6 and 3000 for each child 6 to. Millions of families across the US will be receiving their third advance child tax credit.

Child Tax Credit Available Share with Families. Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid. Families with qualifying children can receive up to 300 a month per child.

WJW While some parents didnt receive the September child tax credit payment because of a. Eligible families who do not opt-out will receive 300 monthly for each child. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17.

The first half of the credit is being delivered in monthly direct deposits from July through December of 300 for children under 6 and 250 for those aged 6 to 17. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17. Eligible families who do not opt-out will receive 300 monthly for each child.

The installment which had already been under. Families can receive 50 of their child tax credit via monthly payments between July 15 and Dec. Subsequent stimulus checks will be sent to households on October 15 November 15 and.

Please look at the time stamp on the story to see when it was last updated. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17.

Eligible families who do not opt-out will receive 300 monthly for each child. There are reports however the. Each qualifying household is eligible to.

15 and while most households have received their payments not all households have been so lucky. What should you do if you havent received a payment or got the wrong amount. The next Advanced Child Tax payment is due to go out on October 15th.

AMERICAN families have complained that they have been shorted money in their September child tax credit payment. The payments were authorized through President Bidens American. The last child tax credit check was issued on Sept.

The 2021 Child Tax Credit Implications For Health Health Affairs

Irs Child Tax Credit Issues Reported With September Payments Kvue Com

Analysis Of The Family Security Act 2 0 Niskanen Center

Stimulus Update Missing Your September Child Tax Credit Payment You Aren T Alone According To The Irs

Child Tax Credit United States Wikipedia

Revised Child Tax Credit Everything You Need To Know Ramseysolutions Com

Frequently Asked Questions On The Child Tax Credit Children S Defense Fund

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

What To Know About The First Advance Child Tax Credit Payment

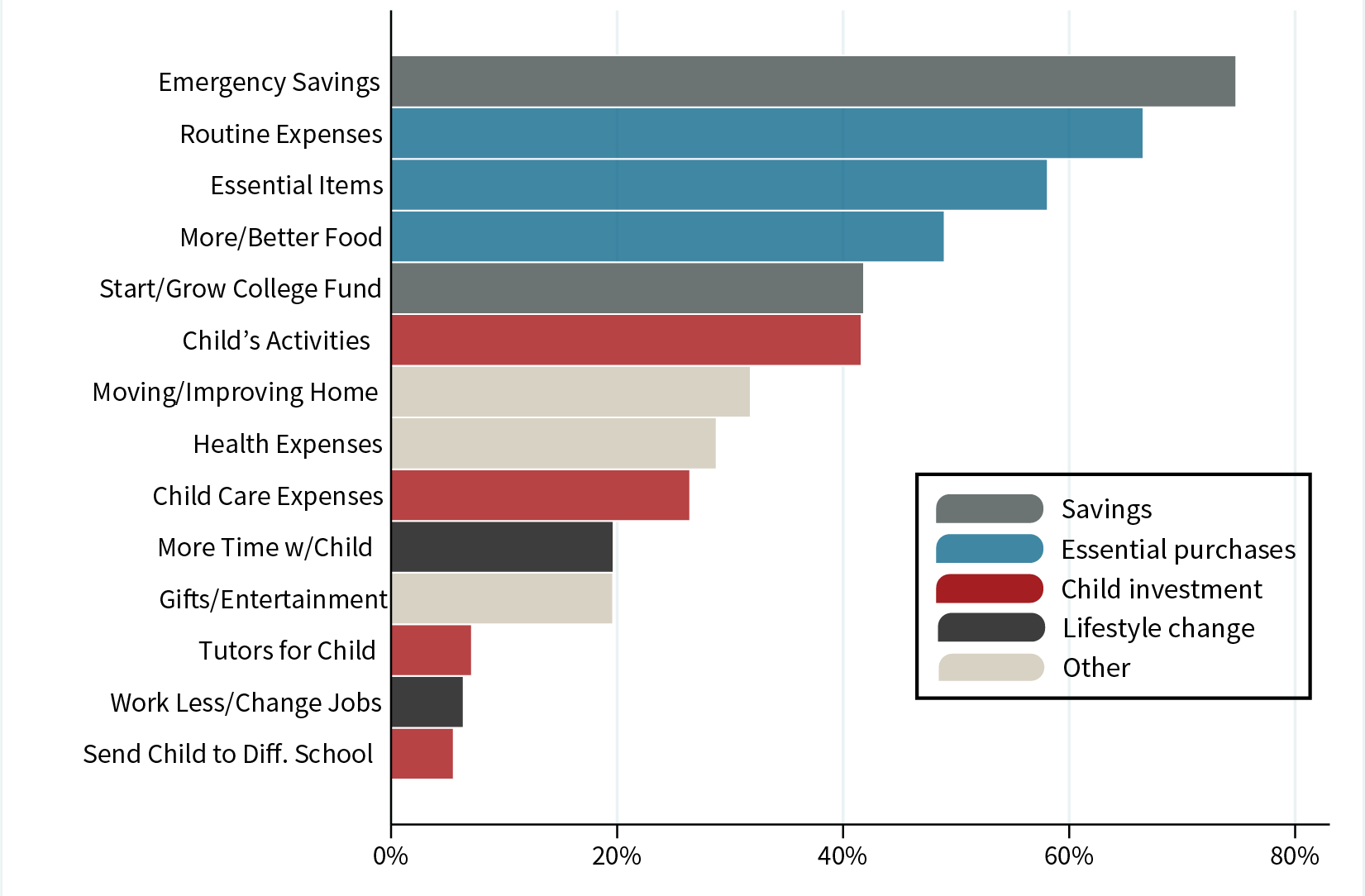

The New Child Tax Credit Does More Than Just Cut Poverty

Is Your September Stimulus Child Tax Credit Payment Delayed Report Outlines What You Need To Know Silive Com

Deadline To Opt Out Of September Child Tax Credit Payment Is Monday Here S How To Cancel It Fingerlakes1 Com

The New Child Tax Credit Does More Than Just Cut Poverty

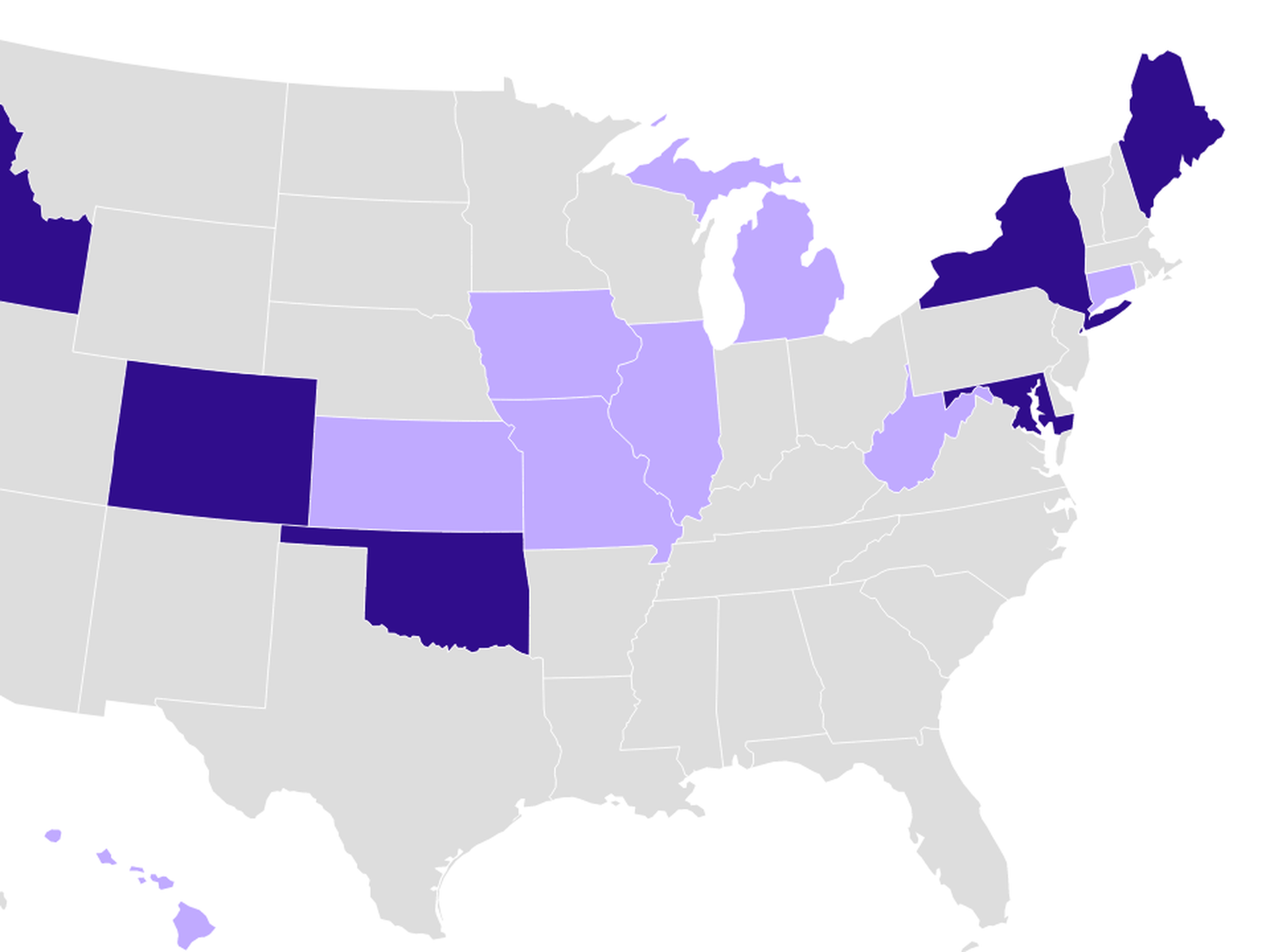

Biden S Child Tax Credit Pays Big In Republican States Popular With Voters Reuters

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

States Expanding Child Tax Credit As Federal Program Set To Expire Jan 1

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet