stanislaus county tax collector property tax

Homeowner low-value property welfare. Find Stanislaus County Online Property Taxes Info From 2022.

Kelly Tillery Senior Collector Revenue Recovery Division Stanislaus County Treasurer Tax Collector Department Stanislaus County Linkedin

Ad Online access to property records of all states in the US.

. Find property records tax records assets values and more. Start Now for Free. The median property tax in Stanislaus County California is 1874 per year for a home worth the median value of 285200.

Please include the stubs for all the properties being paid. 16 dpo implantation bleeding. Ad View All Property Info Online Now.

Find Accurate Home Values Instanty. Census Bureau American Community Survey 2006. Stanislaus County collects on average 066 of a propertys.

Property Tax Distribution for Fiscal Year FY 2017-2018. Ad Searching Up-To-Date Property Records By County Just Got Easier. The Tax Collector is responsible for the billing and collection of secured unsecured supplemental transient occupancy tax as well as various other special assessments for the.

Property Tax Postponement For Senior Blind or Disabled Citizens. Homeowners who are seniors are blind or have a disability can defer current-year property taxes on their principal residence. Instant Accurate Results.

Property Tax Distribution on a countywide basis were allocated as follows. Attack on titan fanfiction eren strangled. Body found in dickinson tx.

The State of California Constitution provides a variety of full and partial exemptions that may lower the propertys tax bill. 800am - 430pm Closed Saturdays Sundays Holidays. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010.

Review the County Budget. The tax rate is 110 of the assessed value. If you do not have the stub s list the parcel number s andor address es on a piece of paper and send it with your payment to.

A home worth 285200 in Stanislaus. Maine coon rescue buffalo ny. The Assessors Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans.

So if your property is assessed at 100000 your annual property taxes would be 1100. First methodist houston staff.

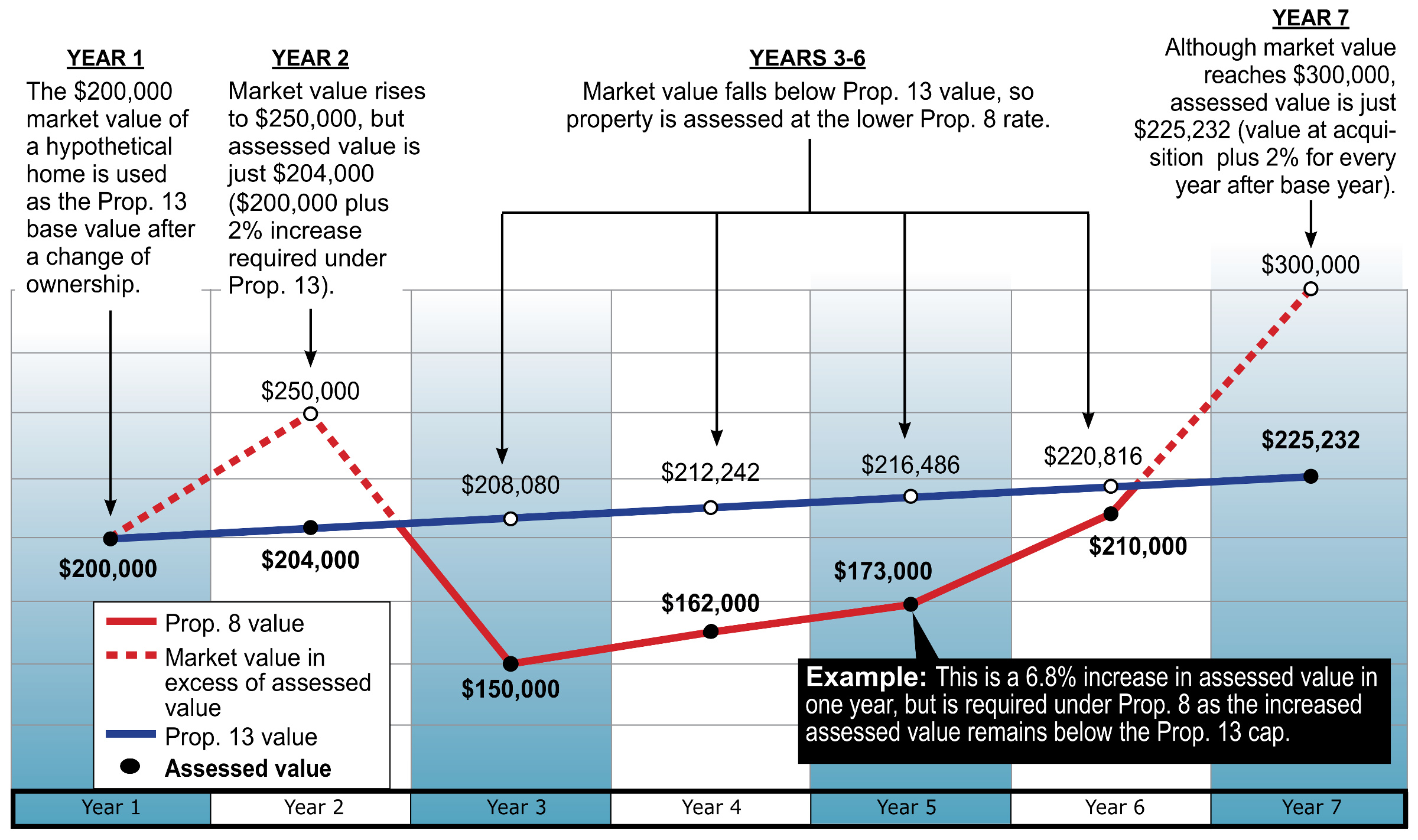

Understanding California S Property Taxes

About Value Increases Assessor S Office Stanislaus County

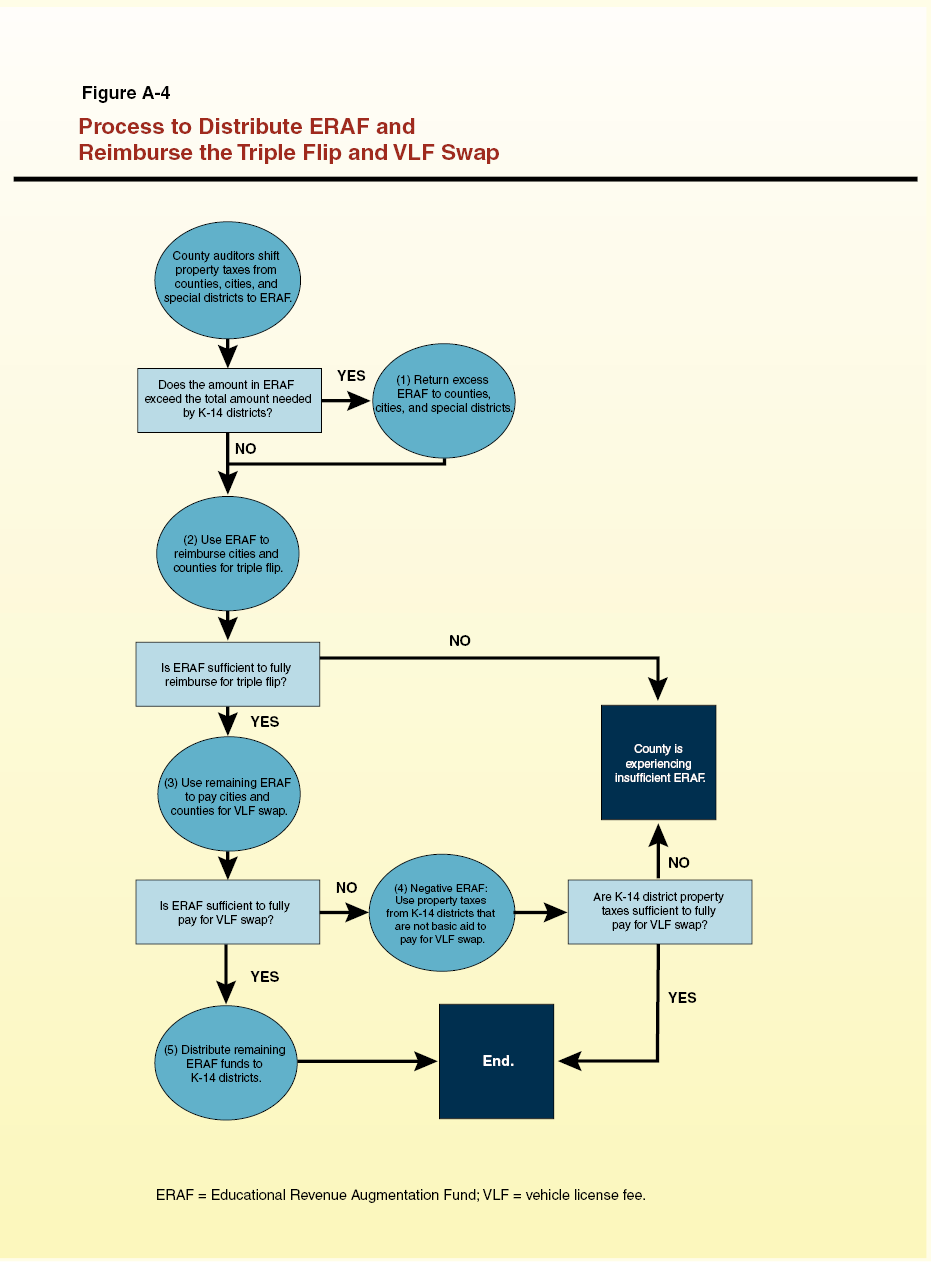

Property Taxes And Assessments Division Auditor Controller Stanislaus County

Office Of The Treasurer Tax Collector Tax Collector Property Tax Frequently Asked Questions Delinquent Property Taxes Faq

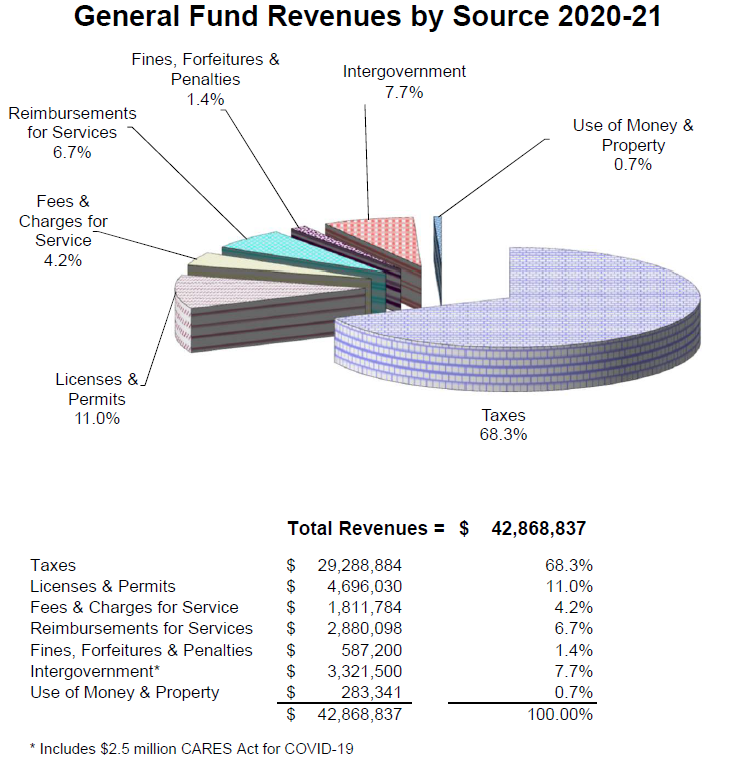

Where The Money Comes From City Of Turlock City Finances Budget

Understanding California S Property Taxes

Stanislaus County Officials Share Info On Covid 19 Efforts Modesto Bee

Delinquent Tax List Stanislaus 1883 Newspapers Com

County Unsecured Property Tax Judgment March 18 2021 Trellis

Kern County Treasurer And Tax Collector

Stanislaus County Urges Relief For Covid Stricken Homeowners Modesto Bee

Revenue Recovery Stanislaus County

Contacts Treasurer Tax Collector Stanislaus County

Property Taxes Due Today Not Quite Theunion Com

Property Tax Division Treasurer Tax Collector Stanislaus County

Contacts Treasurer Tax Collector Stanislaus County

Property Tax Portal Kern County Ca

Property Tax Division Treasurer Tax Collector Stanislaus County